In this article, I write about what should a 20-year-old invest in but before we start..

That was me when I was 17 years old and was wondering what would happen in the next few years when I turn 20.

I was constantly worrying about my future and wasn’t sure if it would turn out to be smooth sailing.

As the years passed and as I grew older, I realised that things weren’t meant to be “smooth sailing” and if you’ve heard of this quote by Franklin D. Roosevelt, it would be perfect in this context

A smooth sea never made a skilled sailor

Franklin D. Roosevelt

I started to understand that it was just the beginning of my learning journey.

Thoughts such as “What should a 20-year-old invest in?” to “What can I do to improve myself as I grow older?” came about.

And if you’re in your 20s, or not. This article can help you understand the different things you can invest in to not only help you financially but in terms of being grateful and self-development as well.

Let’s start with the first noticeably “mindset changing” investment I made which created a ripple effect onto the rest.

TLDR;

- Books

- ETFs (Exchange Traded Funds)

- Relationships

- Courses

- Insurance

- Fitness and Health

- Good wine

- A good dress watch

Books

The first proper book I read was Atomic Habits by James Clear and it basically talks about how our habits make up practically every aspect in our life from why we drink a certain drink to why we just can’t find the motivation to study or work.

You can check out the book summary I wrote about the book with the link above.

After reading that book, I have a completely different mindset to my life and I took actionable steps to improve it such as priming my environment properly whenever I am about to work on my blog to preparing my fitness attire so that it becomes easier to go for that workout.

I began to pick up reading as a habit and read more impactful books such as The 4-Hour Work Week and Think and Grow Rich, you can check this article out for more recommendations.

Reading these books have undoubtedly improved my mindset and outlook in life, making me more positive as well.

Buying a Kindle naturally became the next step as it can store thousands of books and it has also help resolved the pains in reading such as reading in low light to carrying a hefty book around. Take a look at this article on how Kindle can help you with reading.

ETFs

The next investment a 20 year old should invest in is definitely dipping their toes into the Stock market.

What better way to do this is to invest in Exchange Traded Funds or in short, ETFs.

ETFs are basket of stocks that consists of many top companies or “Blue chip” companies as they would call it that are of quality and reliability. Think Facebook, Apple, Amazon.

An example of an ETF would be the S&P500 where the top 500 publicly traded companies are inside.

Why not invest in those companies individually?

The answer to that is, yes you can. However, majority of your money should go into ETFs because historically, the returns you get is between 8 – 10% per annum and it provides a place for you to compound your money.

Don’t get me wrong. You can also compound your money in individual stocks and yes, if you pick the right stocks, maybe, just maybe, you can get the extreme returns from the big tech companies.

However, 90% of professional traders (the ones who probably works at Wall Street) fail to beat the market consistently year after year and the S&P500 is often the benchmark to beat.

Here are the returns of the S&P500 for the past 10 Years with an average return of (15.71%)

The statistics of trading are just not in our favour and it has been proven time and time again, if you invest early and continuously month every month (Dollar Cost Averaging) or yearly, you will end up more often than not, much wealthier.

Are being in your 20s the most optimal time to invest?

Yes and no.

Like what I said previously, the earlier you invest and compound your money, the more beneficial it can be for you. But there’s another way if you invest later than usual which we will discuss later.

Let’s take a look if you were to save your money in the bank instead of investing it.

The estimated return of the bank’s interest rate would be roughly 0.03%.

With an initial deposit of $500 (to open your account) and a monthly savings of $200 for the next 30 years, you will end up with $72,500.

Adding the measly interest rate of 0.03%, you will receive $72,831. A gain of $331 or a 0.45% gain after 30 years.

In the next scenario, let’s take a look if we’ve invested our money in the Stock market (taking the S&P500 as an example)

With the same $72,500 invested on a lower than average rate of return (based on the data above, from 2012 to 2022, the average 10 year return was 15.71%)

You will end up with $305,582. A gain of $233,082 or a 321.49% gain after 30 years.

This is why everyone should invest early. If you have started when you are in your 20s, you will end up with this amount when you are in your 50s.

What’s the other way around?

The other way around that I’ve mentioned in the case you started investing later is to invest a larger amount monthly or annually.

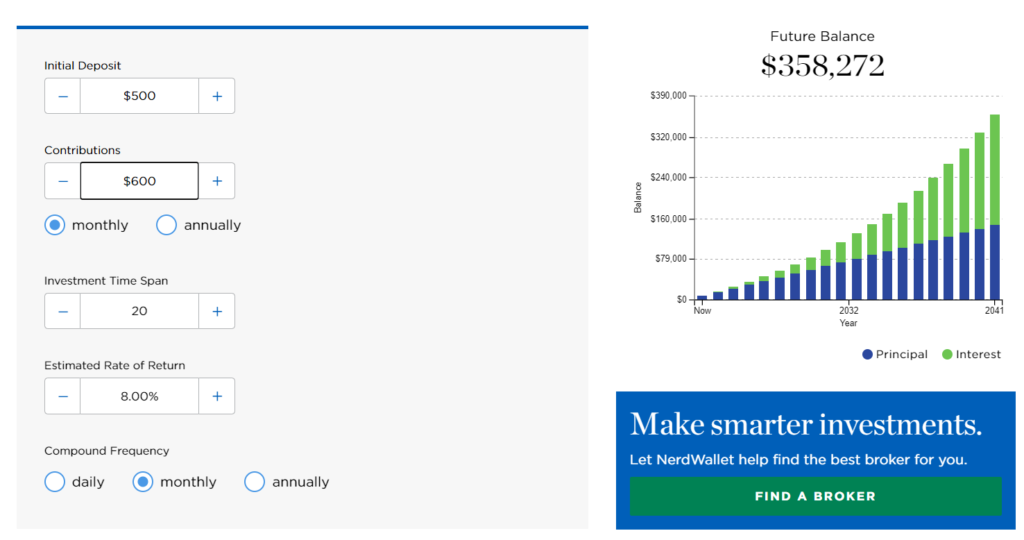

Let’s take a look at the next scenario.

In this scenario, you are only investing for 20 years with the same annual returns of 8%.

However, you are investing $400 more monthly and you will end up with $358,272. Which is significantly more if you’d invested $200 for 30 years. $52,690 more to be exact.

Clearly, the amount of money you can invest also plays a huge role in growing your portfolio. This is why the most optimal way to grow your investments is to invest as early and as much as you can (Make sure you have an emergency fund and that the money you invest are money you are willing to lose because investments are never a guarantee)

Now, do you see why they say time is money?

Here are some links to my other articles talking about the best ETFs to invest in and a guide for beginner investors.

Disclaimer

If you’ve read till this far, thank you and kudos to you in making an effort to develop yourself, both financially and individually.

However, a disclaimer needs to be made that I am not a financial advisor so please do your own diligence before making any kind of investments.

Now let’s move on to the next best investment a 20 year old should invest in.

Relationships

I’d figure that if you’re in your 20s, you are either taking your Degree or have just started working.

This brings us to the point that building good network and relationships is crucial (aside from your friends and family, though they are important too) and it can help you with your career or any other opportunities as well.

While you are studying in your university, do take the time to get to know your peers and find out what goals and ambitions they have.

You’ll never know if you share the same ambitions and goals as well. This could spark a collaboration which you’d never know, could turn into something remarkable.

Aside from that, if you’ve just started working, it is a no-brainer that you should treat your colleagues well and build good relations with them.

Do not do it for the sake of doing it as it can be easy to tell if you’re genuine or not.

You do not want the next few years of your life to be miserable and sulking your way home every day.

With that said, this can be a period of discovery for many as we venture into our new work life, but as important as networking and relationship building may sound, try not to neglect your loved ones such as your family and friends too.

End of the day, be genuinely nice and always have a kind heart regardless of how people treat you. Something my wife always tries to remind me about.

Courses

Courses are the next investments that are worth your time and money.

Similar to books, courses can be a much more interactive way to pick up new skills and knowledge or to further expand them.

If you’re worried that you’ll have to fork out money to pay for good courses, take a look at this platform which offers quality courses for free. (Usually, great courses would require you a bit of money)

I’ve personally attended a few online courses that are free, specifically on social media growth. One thing I find useful is the actionable steps you can take to give your new skills a try.

And no, it does not necessarily need to be something related to business or finance, it can simply be something like Gardening or even Leather Crafting.

Go with whatever interests you and you’ll reap much more benefits from it.

Insurance

No, I am not an Insurance agent and frankly, I don’t believe in some insurance plans such as savings plans (especially when you know how to invest).

However, there are 3 crucial insurance plans that everyone should get and we all know the younger we buy these plans the cheaper it gets.

I dived deep into these 3 plans on my Youtube channel, you can take a look at the video here.

If you prefer to know the plans as you read through the article, they are

- Hospital Insurance

- Accident Insurance

- Life Plan / Term Plan

In the insurance industry, the confusion lies between the Life and Term plan which I’ve explained in depth in the video, so make sure you check it out!

Fitness & Health

This one needs no explanation as Fitness & Health is arguably the most important factor before anything else.

If your health is in a poor condition, money and other material items do not matter and we don’t need to think about contributing or showing our work to the world.

With that said, many people neglect this aspect and jump straight to focusing on making money and other factors (I am guilty of this too).

It is important to invest time into your fitness when you are in your 20s as like every other thing, it compounds.

The earlier you start putting a conscious effort into it, the results will show later when you get older.

I used to work on 2 youtube channels related to Fitness and I share tips on bodyweight workouts, feel free to check them out; CoreCalisthenics & JWLFitness.

So yes, a 20-year-old should invest in their health as well.

Good Wine

You can say that these last 2 points are subjective and not all 20-year-olds should or should not invest in them.

However, my point in writing about these 2 items is to encourage a sense of appreciation for such trivial things.

If you’re a friend of mine reading this article, you’d be surprised that I am writing about alcohol as I am someone who does not frequently drink.

But personally, I feel that 20-year-olds should invest in good bottles of wine just for those lovely date nights and breakthrough occasions on your side-hustle or whenever the occasion calls for it.

Aside from giving yourself an excuse to sip some good wine, I recently found out that wine investment is a thing and apparently if you buy the right ones, the returns can be tremendous (I am not too sure about this so please do your due diligence)

Perhaps let me know in the comments if you are a wine investor or can recommend some good wines!

A Good Dress Watch

As far as I can recall, I grew a fond appreciation of watches back when I was in secondary school.

I started buying some affordable Seikos to start things off and I gradually grew my collection. Wearing a quality and reliable watch has made me feel more confident and naturally makes me look better.

Not that I wear a watch to make myself look better, but I began to appreciate the designs and the workmanship that goes behind every single quality watch.

I bought that watch in the picture above when I was in Iceland back in 2019 and looking at the dial (face) of the watch with the “Reykyavik” engraving, I could never forget the moment and emotions I had when I bought that watch.

Collecting and buying watches at monumental moments is like buying a piece of that memory and keeping it for the rest of your life.

I do remember when and how I acquired all my watches and as I write this, I recall the first gift my wife bought me which was a beautiful dress watch with our names and anniversary date engraved.

If you could feel my sentimentality as I write about my watches, it goes to show why they are worthy investments and why a 20-year-old should invest in them, not just for monetary value (though some good watches like Rolexes appreciate greatly) but for a fond act of remembrance of a significant time or memory whenever you take a glance of your watch.

Conclusion

In conclusion, these are some of the things that I think 20-year-olds should invest in, to either grow their wealth, knowledge, health and appreciation of certain things.

If you find this article interesting or helpful, do share it with your friends or on your socials! I will see you in the next one!