Investing in stocks can be a lucrative way to grow your money. But before you buy, it’s important to do your research and consider a few factors.

Over the past week, the stock market was rocked by the Reddit community and many people lost confidence in how the fundamentals of investing works.

Fret not, to avoid falling to the dark side, here are 4 Things To Do Before Buying a Stock.

Origin Of Company

Before you invest in a company, it’s important to know where the company is located in.

On a macro scale, it helps you to start your research with an understanding of the stability of the economy of the country the company is based in.

Different countries have different structures in terms of their taxes and support for businesses.

Obviously, it is better to invest in a company that’s based in somewhere stable so this should be the first thing to find out.

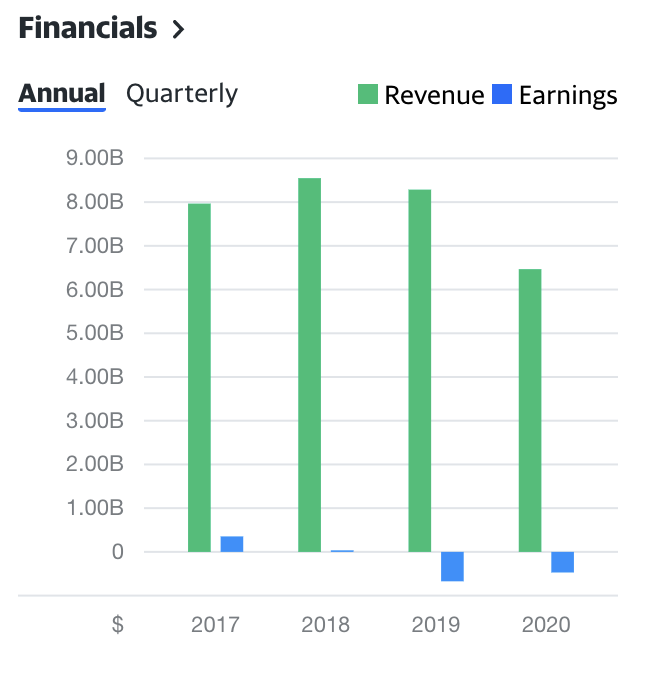

Growth In Earnings

The next thing you should find out is whether there are growth in the company’s earnings.

In an era like now, it is common to miss out on investing fundamentals that clearly reflects how a company is doing.

Many people invest with the hype and sometimes it’s better to understand the basics before making a decision.

This information can be taken from Yahoo Finance once you key in the ticker of the company i.e GME

Insider Information

What better way to understand whether a company is doing well is by looking at what the people in that company is doing.

By looking at the insider transactions at Yahoo Finance, you’ll have a great insight on whether the people in the company are buying or selling the shares.

This becomes a great indicator for everyone.

I mean, would you invest in a company if the people inside are selling away their shares?

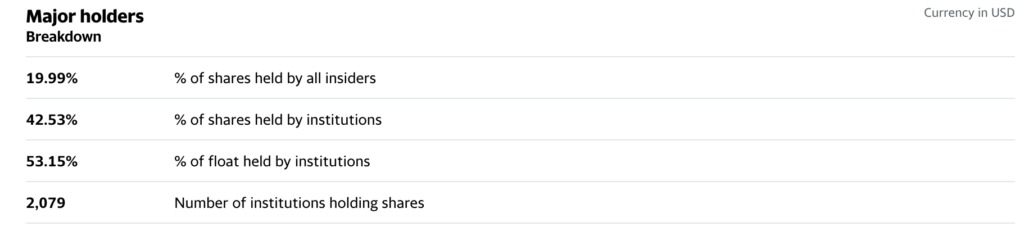

Major Holders

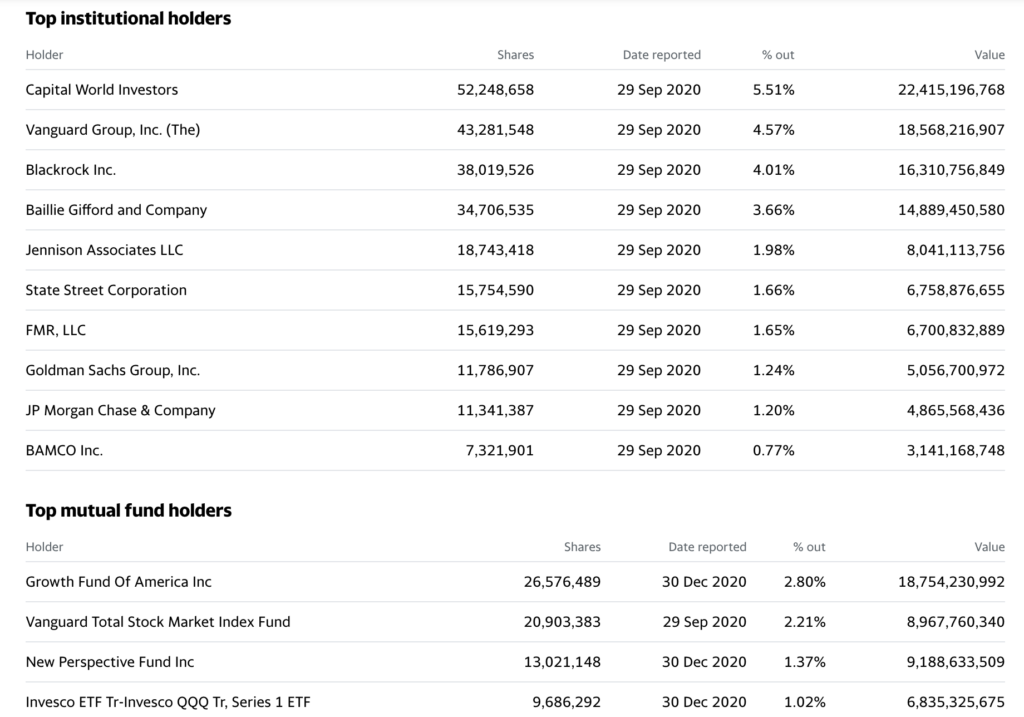

The final thing you should do before pumping your money in a stock is look at the major holders or big institutions that owns the stock.

This breakdown shows the overall holdings of a company from insiders, institutions to the number of institutions holding shares.

If there is a high percentage of shares held by institutions, it can be a good indicator as to whether these major holders have faith in this company in the long run.

You can expand the information to look at the specific institutions holding the amount of shares, the date they reported it, the percentage of shares sold to the value of their holdings.

As important financial sheets may be, these are the 4 things to do before buying a stock or investing in a company.

For beginner investors, this acts as a starting point for you to look at the overall performance of a company so you can make well-informed decisions before taking action.

This is what I personally do before I invest in any stocks and it is how I do my research whenever I find any potential companies.

Generally, this only applies investing for the long term and I am looking at about 3 – 5 years of holding time.

I hope you enjoyed the article, if it helps you, do share it on your socials or leave a comment below!

Here’s how to get started with investing.

Resources Mentioned