“How to get started with investing” is a common question.

This article will help you with getting started on that first step.

If you’ve read my previous article on how to get started with your side hustle, you would’ve known taking that first step is really all that matters for you to reach your goals.

Get Started Early

Investing is one of the many ways to have your money work for you while you sleep.

After the COVID-19 pandemic, you should have learned about the importance of diversifying your money and not just make money from your job.

The beauty of investing early lies in the power of compound interest. The earlier you start investing, the higher the returns in the long run.

“All the benefits in life come from compound interest – relationship, money, habits – anything of importance.” – Naval Ravikant

If you have read my article on the book summary of Atomic Habits, you should have a good understanding of how the mechanics of compounding works and how small “investments” lead to enormous returns.

By investments, it could mean anything like what Naval has said, be it money, relationships or anything of importance.

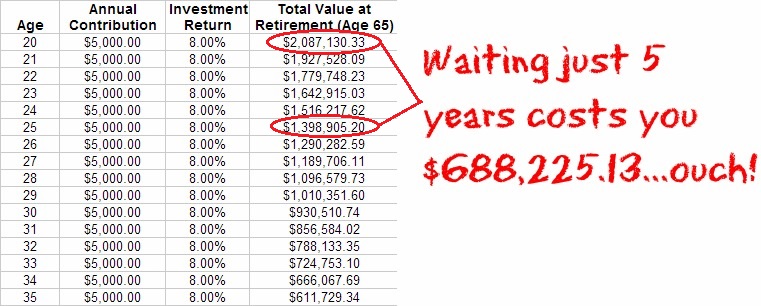

The chart above shows the effect of compound interest.

If you start investing $5,000 annually at 20 years old until you are 65 and with a return of 8%, you will have over $2 million.

If you start 5 years later, that will actually cost you almost $700,000.

Open A Brokerage Account

Now that you know the importance of starting early, let’s open a brokerage account.

A brokerage account is what allows you to purchase stocks or shares from a company and they handle all your transactions.

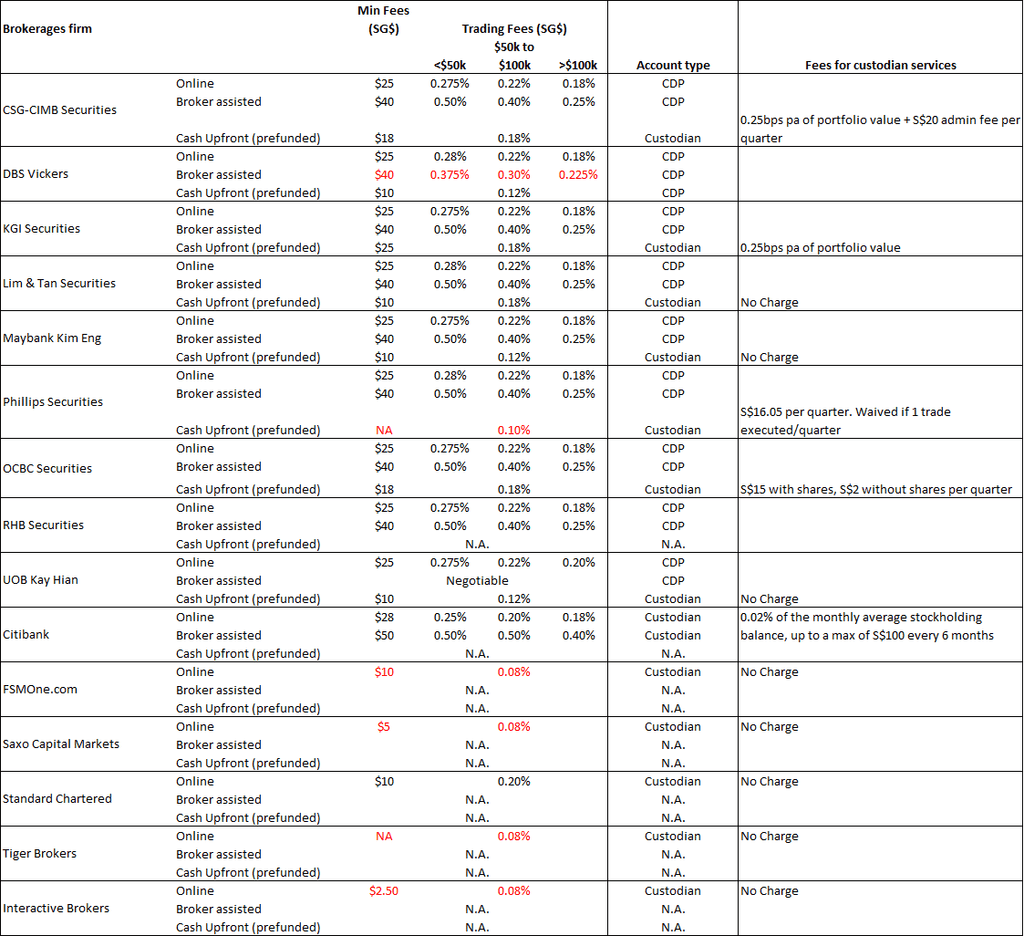

It is important to research on the different brokers as they all have different fees.

Here are the fees for some of the brokers offered in Singapore, this list was updated in November 2020. (For Tiger Brokers, they charge a fee of $1.99 USD per trade)

Do your due diligence and research on these brokers before you open an account with them, this is just a list for you to get started.

Investment Options

CFDs Vs Stocks.

If you stumble upon the term “CFD” (Contracts For Differences) and “Equity”, you may be unsure on which to invest in.

“CFD” is a derivative product which allows you to trade financial assets such as, Forex, Stocks, Indices and Commodities.

The meaning of that is, “CFD” is a method of purchase for the assets you are intending to buy.

When you trade a “CFD”, you are “betting” on whether the the price of this asset (Stock) will increase or decrease.

And once you enter into this financial contract, say you buy “stock a” at $10 and when it increases to $20, you earn the difference.

Advantages Of CFDs

1. Leverage

CFDs are attracting investors due to the ability to increase your purchasing power using leverage.

If you have $1,000 to start investing with, leverage of 2x or 5x will increase your purchasing power for the shares considerably.

You may not have enough money to buy “stock x” which costs $1,500 with a $1,000 capital, leverage helps you to times 2 the amount, bringing your exposure to $2,000.

Bear in mind that leverage will amplify your losses as well.

2. Ability to Buy & Sell

For CFDs, you do not need to buy a stock before you can sell it.

You are able to “sell” stocks if you think it will fall in the short term and this is what makes CFD captivating. With that said, CFDs are suitable for you if you are keen to make some small profits in the short term.

However, this will mean that you are trading and not investing. I will talk about the differences in articles to come.

Advantages Of Stocks (Equities)

Aside from the 2 advantages of CFDs, there is still some upside to investing in equities or buying the stock itself.

1. Ownership

If you buy the actual unit of the stock itself, you own a piece of that company.

As for CFDs, you do not own the shares but you are only “betting” on the price movement of that stock as I have explained.

Psychologically, this makes ownership of the asset feel “more secure” as you are owning shares of the company.

This is a huge consideration between why people invest in CFDs or the equity itself.

2. Shareholder Privileges

Owning shares of a company grants you privileges such as voting rights for the company if any decisions were to be made.

Generally, it is one vote per share.

You may be thinking whether dividends is one of the privileges. Yes it is.

However, CFDs do pay dividends as well if the company pays and they will be credited into your balance if you bought the CFD of the stock before the ex-dividend date.

Understanding The Market

Once you chose between CFDs or equities, you can begin to filter down the list of brokers you’ve researched.

To my understanding, most brokers offer both options and the one I am using is eToro due to the simplicity of the platform.

If you leverage your purchase or “sell” a stock, you will be able to see “CFD” beside the ticker (4 letter symbol) of that stock.

Be aware that if you are starting to invest in the stock market, do expect price fluctuations and your trade can go south quickly if you trade CFDs.

These fluctuations aka “corrections” are normal as the market does not go up in a straight line so do not panic when you come across situations like this.

This reminds me of a famous quote by Warren Buffet,

Rule Number One: Never Lose Money. Rule Number Two: Never Forget Rule Number One

Figuratively speaking, it is impossible to lose your money even when the company performs badly unless you close your position at a loss. The only way to lose is if that company goes bankrupt.

To prevent that from happening, be sure to invest in companies that you strongly believe in and companies that aid in the growth and improvement of mankind.

Another option is to invest in ETFs and Index Funds, in other words, they are basically “stocks” that comprise the largest companies i.e. S&P 500 consisting of the top 500 companies in the US.

Investing that way will help diversify your portfolio and saves time if you are not into picking and researching individual stocks.

Take That First Step

In conclusion, these are the basic information you need on investing.

You should be able to look at the different brokers and compare their fees, depositing funds and make your first investment!

If you’ve enjoyed this article, do let me know down in the comments section!

See you on the next one!

Resouces Mentioned