Hello friends, it’s been awhile since I have consistently uploaded any form of content on YouTube or on my blog. In this article, I will be sharing about the 5 tips for using a credit card.

My 3 biggest milestones in life as a man is coming up in the next half of the year, Marriage, ORD (AKA Operationally Ready Date, end of my 2 year National Service) and my baby.

I’ve told myself to set stepping stones to achieve at least 4 blog posts a month and this shall be the first one this month.

The video I uploaded on YouTube about credit card tips for students is similar to this post, however, I would like to dive deeper in this one.

Let’s begin with the first tip for using a credit card.

1) Start With A Big Expenditure

Yes you’ve read that right, start applying and using your first credit card on your next big expenditure. Some example includes, your university fees, mortgages, weddings, insurance etc.

It does not make sense to pay for a big expenditure using your debit card as you will not receive any rebates, credit score or even credit card rewards. And since we are already spending our hard earned money, might as well get something in return, right?

When my wife had her school fees coming up for her part-time degree, I applied for a credit card for her and paid her first bill in her life on credit.

By doing so, we conveniently met the requirements of a 3% cashback rebate immediately off her first school fee, received a $100 spending voucher and up to $265 worth of Bitcoin. That’s $515 off her school fees.

The credit card we applied for was the “American Express True Cashback” card where we will earn 3% cashback on our first $5,000 spend within the first 6 months, which was perfect to pay off a large expenditure while receiving other rebates and rewards and not forgetting building her first credit score.

Thereafter, she will continue to earn 1.5% cashback on all purchases. If we were to pay her fees with a debit card? None of those will ever happen.

2) Use Credit Only On Fixed Expenses

I’ve talked about this in the YouTube video and this, in my opinion, separates the rich from the poor. Rich people use credit cards for leverage while poor people use credit cards to go broke.

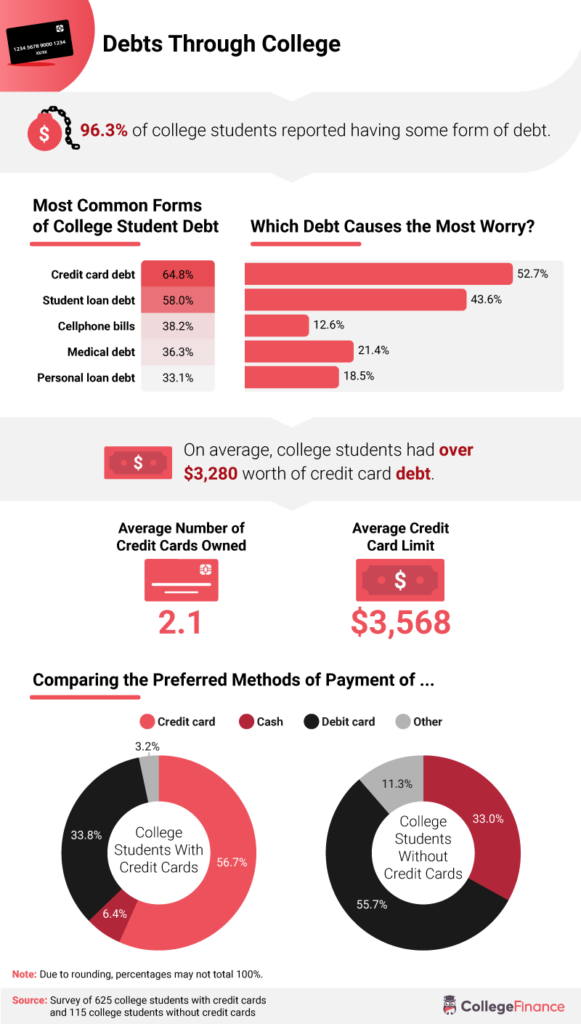

A research from CollegeFinance showed that on average, college students had over $3,280 worth of credit card debt and it is their most preferred methods of payment but with the wrong reasons.

The best tip for you to start using a credit card is to use it only on your fixed monthly expenses such as your insurance, school fees, utility bills etc.

The best way to make this work is to ensure you have a spending debit account and a savings account first. After which, whenever you come across a fixed expense such as your insurance, you take the money from your spending debit account and transfer the expense of your insurance to your savings account.

To bring things into perspective, if your insurance bill is $100 every month, make sure you take $100 from your spending account and transfer it to your savings account and then pay off the $100 bill with your credit card. Once the time comes where you’ll have to pay off your credit bill, you take the $100 from your savings account to pay off the credit bill.

It’s actually not much of a hassle and the reason why you’re transferring your money to your savings account is to ensure that you don’t spend the $100 away which is supposed to pay off your credit bill end of the month.

By doing so, you are building your credit score while you are making a payment which was supposed to be made in the first place.

Breaking it down

To make things less complicated, count how much your monthly fixed expenses are (exclude food at the start) for e.g. $300 and then whenever you receive your paycheck, transfer $300 to your savings account (do not spend anything from your savings account) and use your credit card to pay off that $300 and pay your credit card bill with your savings account at the end of the month or whenever the credit card bill comes.

Once you get more comfortable with it, you can slowly add in other expenditures such as food and entertainment.

This is the best way for you to learn how to be responsible with credit while building your credit score.

3) Building Credit Score (What Is It Really??)

Credit cards are often associated with credit scores and for the most part, it’s probably one of the leading reasons why people use credit cards.

We’ve all heard about credit score and thought to ourselves, “is it really that important? I’ll just use my debit card instead”. As a matter of fact, yes, it’s crucial as we are growing up.

Credit scores are especially important when we are buying a house, taking a loan or even travelling overseas.

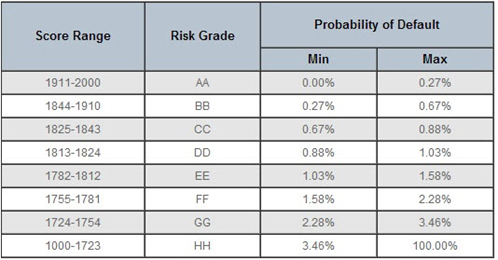

If you have a good credit score (based on Singapore context) which ranges from 1,000 (being poor) to 2,000 (being good) you are more likely to qualify for lower interest rates if you are loaning money from the bank to buy your house or a car.

Apart from benefitting from lower interest rates, you might be able to opt for better repayment terms such as choosing a longer repayment period.

Aside from loaning money, if you have a good credit score, you are entitled to better credit card benefits such as annual credits for dining, travelling or even lounge access. All of these benefits just by paying your money on time.

On top of that, some employers might even check your credit score which says a lot about you before handing over the job to you.

Lesson here? start building your credit score. Generally, it is recommended to use 30% of your credit limit to build a healthy score.

4) Sign Up Bonuses

Moving on to the 4th tip for using your credit card, is to take advantage of sign up bonuses.

Remember the first point in this article which was to start using a credit card on a large expenditure? My wife received some freebies such as the $100 voucher and $265 worth of Bitcoin and these freebies may vary depending on the credit card you apply for.

This is a good website to look out for the different sign up bonuses credit card companies has to offer and depending on your needs and income, you can filter them on the left side shown in the image above.

Some of these sign up bonuses run for a limited time only so be sure to keep yourself updated if you see an upcoming big expense so you can take advantage of the sign up bonuses.

On a separate note, do not apply for a credit card just for the sign up bonus as that is the wrong mentality to own a credit card and sooner or later, you might go into debt if you do not have the right habits.

5) Miles, Cashback or Rewards?

Depending on your needs and income, there are generally 3 categories of credit cards ranging from Miles, Cashback or Rewards.

Miles credit cards lets you earn miles for every dollar spent which you can use to rack up the miles for you to spend on your next flight overseas. It is typically better for people with higher incomes and a high monthly expenditure.

Cashback credit cards gives you cashback from your spending and the cashback come in the form of your credit card bill which you can use to offset the next bill. These cards usually come with a minimum spending requirement every month and its suitable for people with a lower monthly expenditure.

The last type of credit card is the Rewards credit cards. Unlike the cashback credit cards, there are usually no minimum spending requirements and you’d need to spend using this credit card to qualify and redeem rewards from food to air miles. Generally, this is a credit card for anyone unless you have a specific need in mind such as building air miles or taking advantage of cashbacks.

As for my wife’s credit card? Her card falls under the Cashback credit card.

Can you apply for all three of them? Yes you can and you can use them depending on the type of expenditure which grants the best offer for your cards. However, if you’re a beginner who just got a full-time job, do just get one type of credit card and focus on building your credit score first.

Once you’re savvy with this credit card thingy, you will see the benefits of leveraging on the different types of cards and that’s when you can start to take your finances to the next level.

Conclusion

I hope you enjoyed these 5 tips for using your credit card! It is not as complicated as it seems and as long as you cultivate good spending habits and follow these tips in this article, it should point you in the right direction and you’ll be a proud owner of a credit card.

If you’ve enjoyed this article, do check out my previous article as I share my thoughts about the differences between a commission-based job and a 9-5 job as I have to make this decision some time in August after I ORD!

Stay safe and I’ll see you in the next one!