Months into Forex: 17

Another month of trading/learning how to trade has gone and it was a great one. I managed to close 24% in the month of February (demo) but the thing I was happy about was that I stayed disciplined in accordance with my algorithm.

In this episode, I will be talking about the steps I took after I finished BabyPips and how I played around with the things I’ve learned in BabyPips and still didn’t manage to win consistently.

Previously, I spoke about how BabyPips is the best way for any beginners or people from other markets to jump into Forex trading, you can read the article here.

It still is but I felt that I lacked crucial knowledge to become a successful trader after I started trading demo after I finished the course. I was excited and inexperienced, the things that’ll eliminate traders from the Forex market.

Demo Trading

After I completed the course from BabyPips, I created an account with Oanda, one of the most reliable brokers in Forex and started demo trading with the knowledge I had.

It went really well for a few days and I kept seeing my favourite colour in my MetaTrader app (the platform most if not all Forex traders execute their trades with) appearing in my feed.

However, I forgotten I was still a greenhorn and was blinded by my demo account.

I wasn’t trading the capital I would like to start with using my demo account, my risks weren’t calculated which in return, causes my lot sizes to be random.

After which, my friend came to me and told me that I lacked Money Management and Trading Psychology. He gave me the next resource which was the one that made him become a successful trader trading the No Nonsense Forex way.

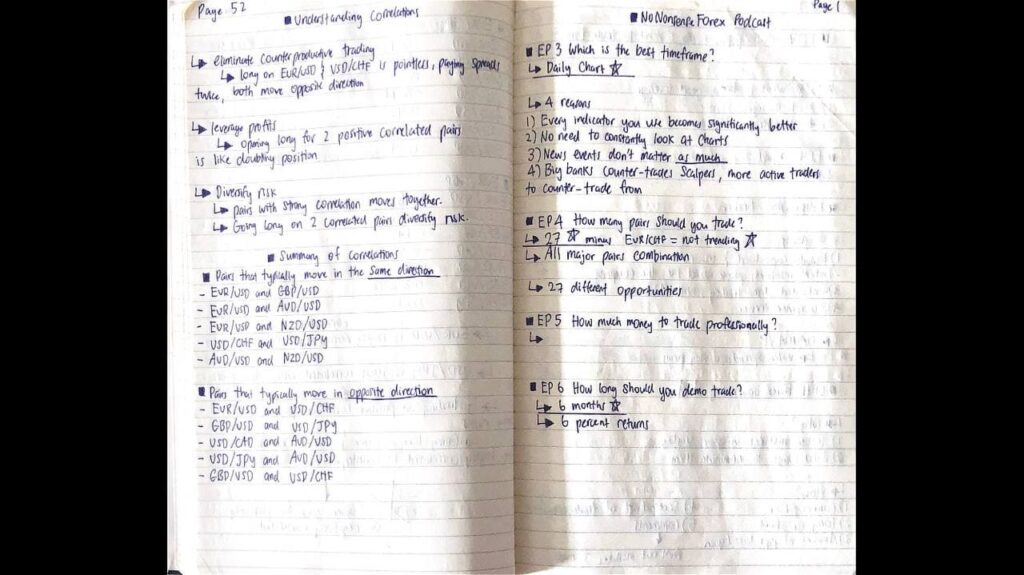

No Nonsense Forex

The person that moulded my friend into a successful trader shares his unorthodox structure of trading Forex on Youtube and his blog.

VP, that’s what he always call himself in his videos, claims that he has traded Forex for a long time (I think it was 10 years if not more) and has made all the mistakes that he could’ve made. He was a former sports bettor and penny stock trader and claims that he found a way to trade the markets without using much time.

He has about 160 videos back then and I was told by my friend to consume all his videos before I can think of starting. Determined but low on morale, I thought I had done what it takes to become a somewhat successful trader, I was dead wrong.

I began by watching his beginner video and found out that he has made his contents in a way that you cannot afford to be lazy and skip through the contents or videos but you have to go through it one by one.

Trading Psychology & Money Management

He has a few playlists, mainly, “Forex Trading Psychology”, “Forex Money Management” and “Forex Core Concepts”. The core concepts were the things I’ve learned from BabyPips such as using the different indicators to your advantage and to tell a trend but what VP emphasized was, the first 2 mentioned are actually the main things traders need to take note of and it was what I lacked.

In his beginner video, he also mentioned that he trades differently from everyone as he only uses indicators to build an algorithm and he only trades the daily timeframe.

Back at this period, I was emotional and psychologically, felt that I was unable to do it.

As I was going through the videos, I was still actively trading on my demo account as it felt “good” to see my profits roll. This was really bad psychologically as I felt that I am able to do the same if I were to open a live account.

It may sound stupid but even experienced traders struggle to prevent emotions from interfering.

To make things worse, the things that VP taught had little to no relation to most of the things in BabyPips, it was completely different. He still recommended everyone to start from there as it teaches you the basics of getting in and out of a trade.

Inevitably, I felt that I had wasted my time going through BabyPips and that my friend could’ve taught me the basics.

Conclusion

Fast forward a little, It was not a waste of time but it was the magic of compounding my knowledge, maintaining my expectations and most importantly, building the right trading psychology.

If I had done things differently, it would’ve been building my knowledge on a weak foundation and I’d probably have quitted.

I will share with you my journey with No Nonsense Forex on the next episode and the structure he swears by which has helped my friend in becoming successful trading.

If you enjoyed this article, be sure to check out the previous one on the 5 most motivational movies for entrepreneurs and do not miss the first episode of this How To Trade Forex series.

Thanks for reading! See you on the next one!

Resources